Natural gas is one of the primary fuels for NC State’s campus utility plants, and fluctuating and rising natural gas prices are increasingly a reality.

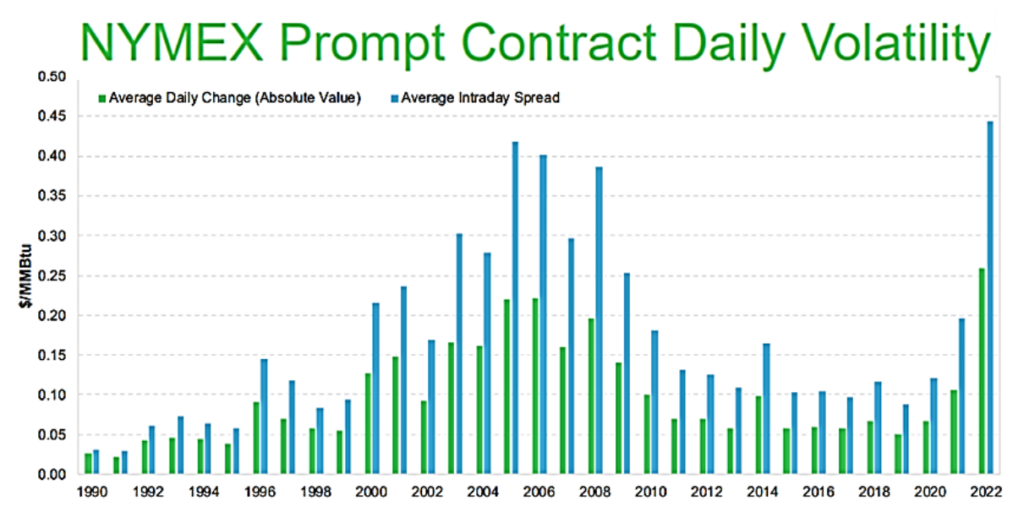

NC State Energy Management utilizes natural gas hedging to protect the university from price volatility caused by weather, politics, market sentiments and natural gas storage levels. This volatility is mitigated by entering future contracts at more economical rates for the upcoming two fiscal years. These contracts anticipate uncertainties in the market and shelter NC State from short-term pricing fluctuations that, if continued for an extended period, could overextend the university’s utility budget.

NC State Energy Management coordinates with university purchasing, risk consultants and gas shippers to commit to high-volume purchases in the future at a lower rate. About half of the university’s natural gas use is purchased through hedging.

The other half is purchased on spot markets to maintain Weighted Average Cost of Gas (WACOG) at reasonable levels in the future. Spot market prices are more vulnerable to cost fluctuations, and every penny and minutes counts while making a trade decision due to price volatility. All coordinating units communicate in real-time to lock in rates within a brief period, usually within 10 minutes.

This purchasing strategy is an important part of Energy Management’s multi-faceted effort to steward the university’s energy usage and costs.